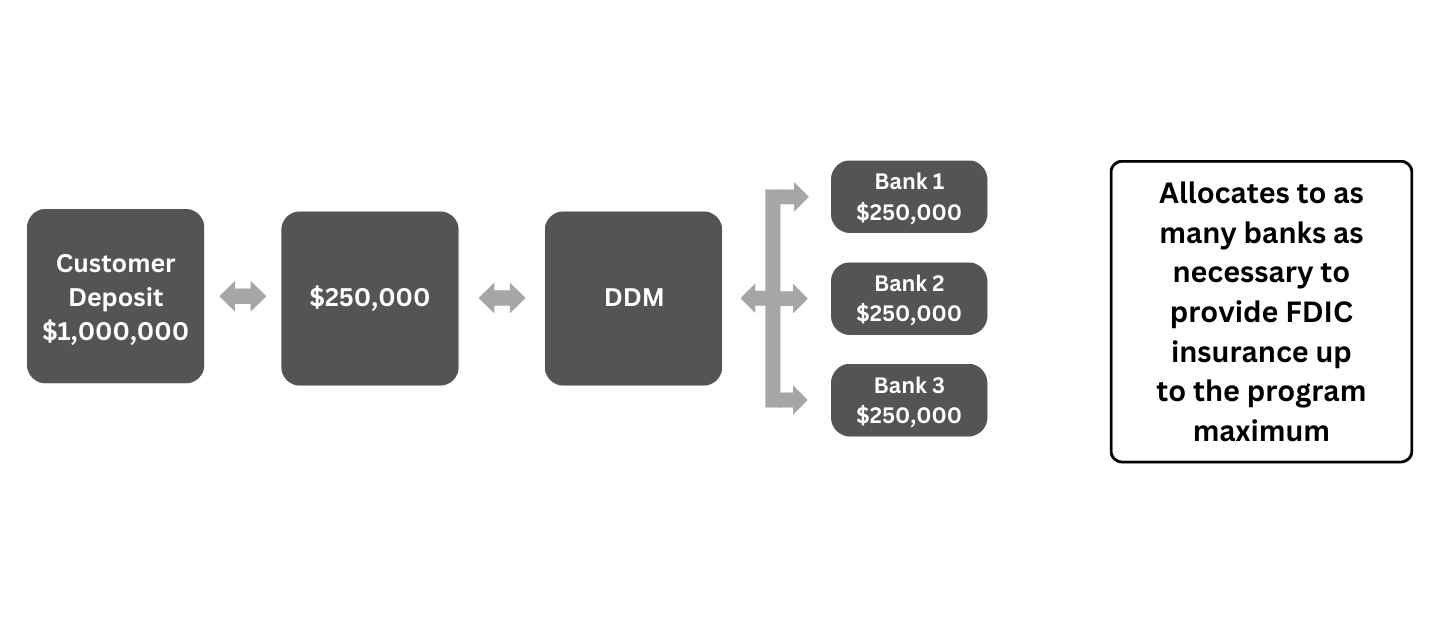

How DDM Works

Customer cash balances are sent daily into the DDM program and allocated into several program banks to ensure high levels of FDIC Insurance.

- What is the Demand Deposit Marketplace® (DDM) Program?

- The Demand Deposit Marketplace (DDM) program is a liquid FDIC insured alternative to money market mutual funds. It enables customers of financial institutions participating in the DDM program (“DDM Participating Institutions”) to obtain millions of dollars of FDIC insurance with daily liquidity.

- What is the FDIC insurance limit in the account?

- Joint accounts receive up to $100 million in FDIC insurance and all other account types receive up to $50 million per TIN. However, individuals in different categories of legal ownership may receive higher amounts.

- How are high levels of FDIC insurance achieved?

- Cash balances in customer accounts are placed daily into the DDM program. These deposits are allocated in increments of no more than $250,000 to multiple DDM Receiving Banks, which abides by the FDIC pass-through insurance provisions established by the FDIC. By allocating deposits to multiple banks, customers receive high levels of FDIC insurance while maintaining daily liquidity and the convenience of maintaining one bank relationship.

- When placed into the DDM program the following business day, are customers’ deposits insured?

- Until the customers’ funds are placed into the DDM program, such funds will be uninsured to the extent they remain at their Participating Institution overnight in excess of any FDIC insurance available on balances kept at their Participating Institution. Their funds will be insured on the following business day once transferred to the Program.

- What if the customer does not want their money deposited in a particular DDM Receiving Bank?

- Customers have the option to exclude any DDM Receiving Bank they choose.

- How is the DDM program different from a money market mutual fund sweep?

- Unlike DDM, money market mutual funds are not FDIC insured. Operationally the DDM program works similarly to a money market mutual fund sweep, however, deposits are placed into insured accounts held at several FDIC insured program banks instead of pooled money fund investments.

- What are the advantages of an FDIC insured account versus a money market mutual fund?

- Provides the safety and explicit guarantee of FDIC insurance backed by the full faith and credit of the US Government that money funds do not offer;

- Eliminates market risks associated with money fund investing;

- Is outside the scope of the SEC’s money fund reforms;

- Offers a highly competitive yield

- Can placing funds in the DDM program decrease customers’ overall portfolio risk?

- Yes. FDIC insured placements reduces the market risks associated with money market mutual fund investing and other direct cash instruments.

For more information, please contact your bank representative.

The Demand Deposit Marketplace® (“DDM”) program is offered to you by Rio Bank (“us” or “we”), subject to the terms and conditions set forth in the DDM program Terms & Conditions provided to you. Please liaise with us regarding your participation in the DDM program, including for the DDM program Terms & Conditions, your customer statements and any questions you may have. Please contact us for a list of banks and other institutions into which your funds could be deposited through the DDM program. The DDM program is administered by Stable Custody Group II LLC (“Stable”). Stable and its affiliates are not depositories, banks or credit unions, and the DDM program is NOT, itself, an FDIC-insured or NCUSIF-insured product. Rather, under the DDM program, your funds are swept or placed into deposit accounts at participating banks or other financial institutions that are insured by the Federal Deposit Insurance Corporation (“FDIC”) and/or National Credit Union Share Insurance Fund (“NCUSIF”) for up to the current standard maximum deposit insurance amount (“SMDIA”) of $250,000 per eligible depositor, per insured participating institution, for each ownership capacity or category, including any other balances the depositor may hold at that institution directly or through other intermediaries, including broker-dealers. FDIC and NCUSIF insurance coverage is only available to protect you against the failure of a FDIC or NCUSIF insured institution, respectively, that holds your deposits under the DDM program (and not to protect against the failure of any other party, including Stable). The DDM program is primarily designed to provide administrative convenience for us to offer expanded FDIC or NCUSIF insurance on your funds, and is not designed to provide you with investment enhancements, higher rates of returns or profits on their funds. Demand Deposit Marketplace®, DDM®, Reich & Tang® and R&T® are registered marks of Reich & Tang Deposit Networks, LLC (“R&T”). Stable is a subsidiary of R&T.

|